Following her appointment as chancellor, IIMI has written to Rachel Reeves to share some ideas for regulatory reforms with a view to promoting a competitive and inclusive UK asset management industry. This letter was written in consultation with our membership and has been shared widely within the industry.

Category: Policy Papers

Since the UK voted to leave the EU, the Independent Investment

Management Initiative (IIMI) has been making the case for the

UK to adopt its own globally competitive asset management

regime. In February 2023, the UK Financial Conduct Authority

(FCA) released its latest discussion paper (DP 23/2) – “Updating

and Improving the UK Regime for Asset Management” – as

part of the so-called Edinburgh Reforms, a Government

initiative designed to stimulate growth and competitiveness

in the UK’s financial services industry post-Brexit.

Under the UK’s Financial Services and Markets Bill (FSMB), the

UK Government will be given extensive powers to overhaul,

amend or retain EU regulations as it applies to financial services,

including asset management. The IIMI looks at the latest

FCA discussion paper, and shares its insights on some of the

proposals. As part of this white paper, the IIMI spoke extensively

with its diverse membership of boutique asset managers,

along with a number of external law firms and consultants

In a macro environment where revenue-generating opportunities have been fairly limited, it is no surprise that investors are searching for alpha in some of the more esoteric corners of the market. In some instances, investors – both retail and institutional – have accumulated positions in digital assets, such as crypto-currencies.

This paper by the Independent Investment Management Initiative (IIMI) argues that crypto-currencies and StableCoins need to be subject to stringent oversight and regulation. Additionally, the paper will examine some of the benefits and challenges of other digital assets – namely security tokens and CBDCs (central bank digital currencies).

IIMI’s Calls For Action

- IIMI members are sceptical about the merits of unregulated crypto-currencies, and we welcome further regulatory oversight of this marketplace, including greater oversight of crypto-asset service providers – especially in light of recent events.

- Although IIMI’s membership is largely agnostic about tokenisation, this technology has the potential to improve access to retail investment in the future.

As the UK recovers from COVID-19, it is vital that the country’s highly successful asset management industry remains competitive. While Brexit has thrown up a number of operational and logistical challenges for domestic asset managers marketing into the EU, the UK’s new-found autonomy does give it much greater flexibility to shape regulation and policy as it relates to funds. The Independent Investment Management Initiative (IIMI) spoke to its diverse membership about how the UK government could potentially stimulate future growth in the asset management sector.

IIMI’s Recommendations

- The UK regulator should consider streamlining the fund authorisation process-especially for managers who are only selling their products to institutional investors.

- There needs to be greater engagement by the regulator with the industry about ways to strengthen and enhance the UK asset management sector’s position in the global market. The UK regulator also needs to replicate its peers in Luxembourg and Ireland in terms of its commitment to promoting the UK as an asset management hub.

- Reform of certain regulations – such as PRIIPs – would help support the local funds industry, as would sweeping changes to existing VAT rules.

- If such reforms are enacted, there is likely to be greater re-domiciliation of funds into the UK – a shift which could result in asset servicing jobs being created across the entire country.

Investor appetite for ESG (environment, social, governance)-focussed funds is reaching new heights, fuelled by a combination of the asset class’ perceived performance benefits; regulatory intervention; and growing fears about stranded asset risk. According to Morningstar data, ESG funds accumulated $139.2 billion in net inflows during the second quarter of 2021, bringing total AuM (assets under management) to $2.3 trillion.1 Following COP26, 220 asset managers representing $57 trillion in AuM – signed up to the Net Zero Asset Managers Initiative – in what is further indicative of the industry’s commitment to ESG.

Amid the ESG asset class’ strong growth, regulators – particularly in the UK- are keen to ensure standards remain high – following growing concerns about potential greenwashing. Greenwashing is a problem which the IIMI [Independent Investment Management Initiative] – together with its members – is looking to counter. IIMI recently polled its membership, which is comprised of leading independent asset management firms from the UK and Continental Europe, to gather their views on the recent steps taken by the UK’s Financial Conduct Authority (FCA) around ESG.

Key Points

- IIMI fully supports the FCA’s guiding principles and proposals to make TCFD reporting mandatory as it believes this will root out greenwashing.

- The UK must carefully consider the unintended consequences of potential overlap and divergence with other ESG regimes.

- With more markets increasingly adopting ESG legislation, an element of standardisation is required, otherwise, it could create further confusion. This is something that IIMI is willing to engage with regulators about.

ESG (environment, social, governance) investment practices are now being fully embraced by the global asset management industry. The COVID-19 crisis has accelerated a number of pre-existing trends and the growing investor appetite for ESG is one of them. COVID-19 has served as a stark reminder to investors about just how vulnerable our planet is to disruption. In turn, this has prompted more investors to pile into ESG-focused funds. Between April and June 2020, Morningstar found that ESG funds attracted inflows totalling $71.1 billion, turbo-charging their assets under management (AUM) to above $1 trillion. Investor demand for ESG products is only expected to grow with PwC estimating that ESG funds will hold more assets than their non-ESG equivalents by as early as 2025. PwC added sustainable and responsible investment funds could control up to €7.6 trillion in Europe in the next five years, accounting for 57% of market share, versus the 15% they have today.

Key Points

- IIMI membership largely supports the SFDR, but there are concerns in some quarters that the rules could create an imbalance between boutiques and larger asset managers.

- Some member firms have called on EU regulators to cap the amount which data providers can charge for ESG research and analytics in order to create a more even playing field between boutiques and the larger investment managers.

- The ongoing uncertainties around SFDR – namely around article 8 designation – need to be clarified.

- IIMI fully supports the principles behind an ESG taxonomy insofar as that it will be vital in eliminating the risk of greenwashing.

- It is vital that ESG standards across major markets do not diverge excessively otherwise it could lead to confusion.

I am pleased to introduce this paper on the opportunities for decentralising fund management in the UK and encouraging regional growth.

Innovation by entrepreneurial UK asset managers in delivering access to investment markets via collective investment schemes has gone hand in hand over the years with the development of ever wider investment expertise. The lawyer Philip Rose founded The Foreign & Colonial General Trust in 1868, and Ian Fairbairn and George Booth launched M&G’s First British Fixed Trust in 1931 to replicate the resilience and popularity of mutual funds in the United States. Adaptation and evolution have continued over the years to allow UK asset and wealth management firms to remain competitive in delivering their investment expertise to different categories of client. Unit Trusts have morphed into OEICs, and front end charges and bid/offer spreads have disappeared.

Both fresh and familiar challenges, from the COVID economic shock to Brexit, are emerging which make the UK ripe for a new generation fund structure which could also be a catalyst for industry and job growth in servicing the assets invested in a new UK domiciled fund structure.

Nick Mottram

Chairman, New City Initiative

Partner & Chairman, Dalton Strategic Partnership LLP

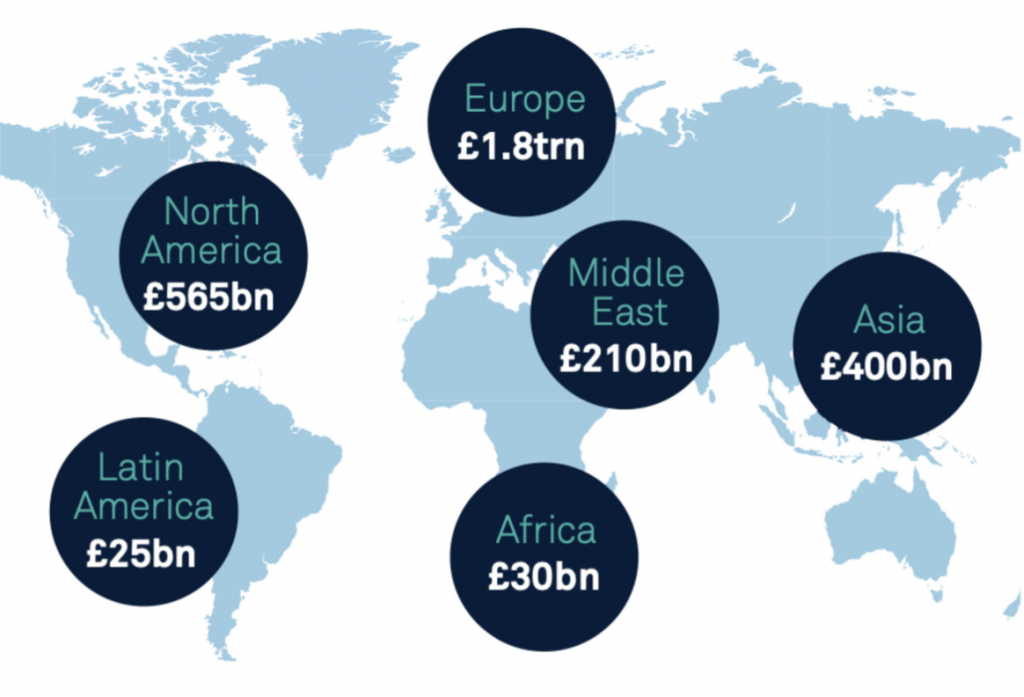

Despite the relentless political uncertainty gripping the UK, the country’s position as one of the dominant centres for investment management in the world remains unaffected. Second only to the US by size, the UK’s asset management industry is responsible for overseeing £7.7 trillion in capital, of which £3.1 trillion are mandates on behalf of foreign investors, a figure that is largely unchanged since 2017. The European Economic Area (plus Switzerland) accounts for the majority (59%) of the foreign sourced assets controlled by domestic UK fund houses although non-EEA capital comprises a large proportion of that AuM total too.

In the aftermath of the financial crisis, many asset managers saw M&A (mergers & acquisitions) with their competitors as a means to survival, principally a necessary evil by which to preserve their businesses amid the tumbling markets and as a counterweight to offset the sheer volume of client redemptions. Since then, M&A has only accelerated at major asset managers, as firms look to create economies of scale facilitating investor diversification and wider product distribution footprints. These larger enterprises can also better absorb the increasing operational and regulatory costs that come with running an asset management business in 2019. However, this rush towards consolidation carries risks.

In this paper, NCI looks at some of the implications which M&A is having on the boutique asset manager community. It also questions whether decisive action needs to be taken at a governmental or regulatory level to further scrutinise this M&A activity, especially if there is evidence that these transactions are drowning out competition and undermining investor choice. As part of this analysis into M&A trends within the industry, NCI spoke to a number of its diverse boutique asset manager members about the impact consolidation was having.

NCI considers the unique and considered perspective of its members, the SMEs of the asset management industry and broader financial services, in guiding a path for the future of financial services. The political and regulatory response to the Global Financial Crisis led to a focus on larger firms and the banking sector, and reforms implemented in response have sometimes led to unintended consequences, for example in the effect of liquidity regulations on the asset management sector and increased barriers to entry. Now that ten years have passed, and with the UK’s focus on opportunities for the future, NCI submits that it is now the time for an alternative, bottom-up approach that draws from the wisdom and efforts of the SME sector. Drawing upon its past work, NCI shows how its members offer a distinct and important contribution to the debate about the future of financial services, concluding that any consultations and working parties must include their representatives to give the optimal outcome for the broader economy and society.