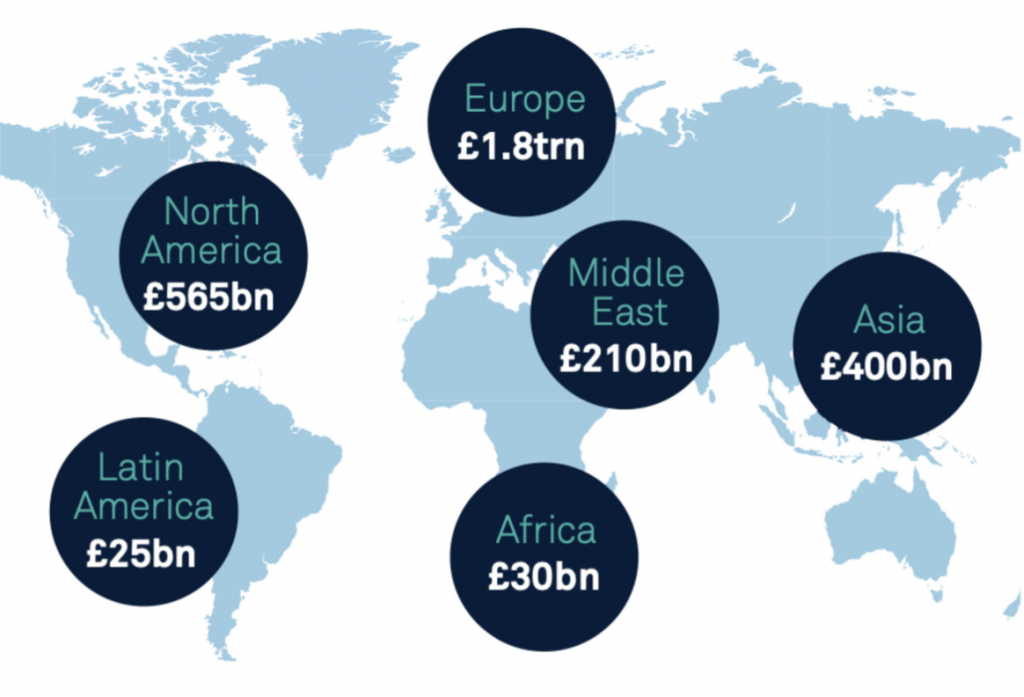

Despite the relentless political uncertainty gripping the UK, the country’s position as one of the dominant centres for investment management in the world remains unaffected. Second only to the US by size, the UK’s asset management industry is responsible for overseeing £7.7 trillion in capital, of which £3.1 trillion are mandates on behalf of foreign investors, a figure that is largely unchanged since 2017. The European Economic Area (plus Switzerland) accounts for the majority (59%) of the foreign sourced assets controlled by domestic UK fund houses although non-EEA capital comprises a large proportion of that AuM total too.